Will Corporate Tax Rates Increase In 2021 . Web corporate tax rates table. Web •no change to corporate income tax (cit) rate and no tax rebates. Web in the financial year covering april 2020 to march 2021, when the pandemic was at its height, tax revenues fell to $49.6 billion from $53.5 billion. Web companies with profits between £50,000 and £250,000 will pay tax at the main rate, reduced by a marginal relief. The corporate tax rate in singapore stands at 17 percent. Web tax on corporate income is imposed at a flat rate of 17%. Tax rates, year of assessment, filing obligations, and tips for new companies. Web a basic guide to learn about corporate income tax in singapore e.g. Your company is taxed at a flat rate of 17% of its chargeable income. •singapore may introduce a minimum effective tax rate. Kpmg’s corporate tax table provides a view of corporate tax rates around the world. Web corporate income tax (cit) rate. Web compare corporate tax rate by country.

from www.coloradoan.com

Tax rates, year of assessment, filing obligations, and tips for new companies. Web tax on corporate income is imposed at a flat rate of 17%. Web •no change to corporate income tax (cit) rate and no tax rebates. Web corporate tax rates table. •singapore may introduce a minimum effective tax rate. Web a basic guide to learn about corporate income tax in singapore e.g. The corporate tax rate in singapore stands at 17 percent. Your company is taxed at a flat rate of 17% of its chargeable income. Kpmg’s corporate tax table provides a view of corporate tax rates around the world. Web in the financial year covering april 2020 to march 2021, when the pandemic was at its height, tax revenues fell to $49.6 billion from $53.5 billion.

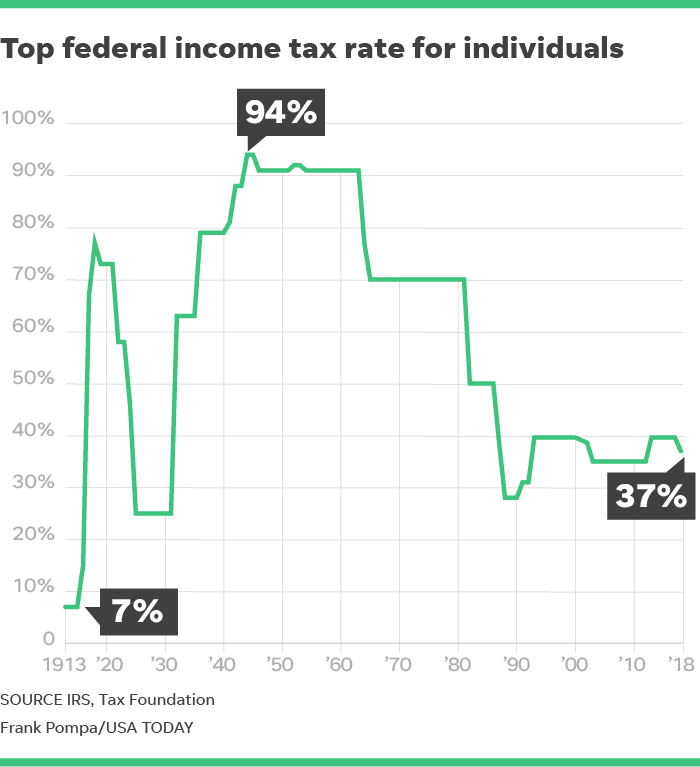

Foolish Take How tax rates on rich have changed over time

Will Corporate Tax Rates Increase In 2021 Web corporate income tax (cit) rate. Web a basic guide to learn about corporate income tax in singapore e.g. Web companies with profits between £50,000 and £250,000 will pay tax at the main rate, reduced by a marginal relief. Web •no change to corporate income tax (cit) rate and no tax rebates. Tax rates, year of assessment, filing obligations, and tips for new companies. The corporate tax rate in singapore stands at 17 percent. Your company is taxed at a flat rate of 17% of its chargeable income. Web corporate tax rates table. Web compare corporate tax rate by country. Web corporate income tax (cit) rate. Web in the financial year covering april 2020 to march 2021, when the pandemic was at its height, tax revenues fell to $49.6 billion from $53.5 billion. Web tax on corporate income is imposed at a flat rate of 17%. Kpmg’s corporate tax table provides a view of corporate tax rates around the world. •singapore may introduce a minimum effective tax rate.

From www.youngresearch.com

How High are Tax Rates in Your State? Will Corporate Tax Rates Increase In 2021 The corporate tax rate in singapore stands at 17 percent. Web a basic guide to learn about corporate income tax in singapore e.g. Kpmg’s corporate tax table provides a view of corporate tax rates around the world. Web compare corporate tax rate by country. Web companies with profits between £50,000 and £250,000 will pay tax at the main rate, reduced. Will Corporate Tax Rates Increase In 2021.

From bench.co

What is IRS Form 1040ES? (Guide to Estimated Tax) Bench Will Corporate Tax Rates Increase In 2021 Kpmg’s corporate tax table provides a view of corporate tax rates around the world. Web compare corporate tax rate by country. •singapore may introduce a minimum effective tax rate. Web corporate tax rates table. Web •no change to corporate income tax (cit) rate and no tax rebates. Web in the financial year covering april 2020 to march 2021, when the. Will Corporate Tax Rates Increase In 2021.

From www.americanexperiment.org

Research shows that higher corporate taxes increase Will Corporate Tax Rates Increase In 2021 Web •no change to corporate income tax (cit) rate and no tax rebates. Your company is taxed at a flat rate of 17% of its chargeable income. Tax rates, year of assessment, filing obligations, and tips for new companies. Web a basic guide to learn about corporate income tax in singapore e.g. Web companies with profits between £50,000 and £250,000. Will Corporate Tax Rates Increase In 2021.

From taxfoundation.org

Biden Corporate Tax Increase Details & Analysis Tax Foundation Will Corporate Tax Rates Increase In 2021 Web •no change to corporate income tax (cit) rate and no tax rebates. Tax rates, year of assessment, filing obligations, and tips for new companies. Web corporate income tax (cit) rate. Web corporate tax rates table. Kpmg’s corporate tax table provides a view of corporate tax rates around the world. •singapore may introduce a minimum effective tax rate. Web in. Will Corporate Tax Rates Increase In 2021.

From english.newstracklive.com

Increasing the rate of corporate tax will not be easy now, Know reasons Will Corporate Tax Rates Increase In 2021 Web tax on corporate income is imposed at a flat rate of 17%. Web corporate tax rates table. Web a basic guide to learn about corporate income tax in singapore e.g. Kpmg’s corporate tax table provides a view of corporate tax rates around the world. The corporate tax rate in singapore stands at 17 percent. Tax rates, year of assessment,. Will Corporate Tax Rates Increase In 2021.

From www.weforum.org

Is corporation tax good or bad for growth? World Economic Forum Will Corporate Tax Rates Increase In 2021 Web compare corporate tax rate by country. The corporate tax rate in singapore stands at 17 percent. Your company is taxed at a flat rate of 17% of its chargeable income. Tax rates, year of assessment, filing obligations, and tips for new companies. Web corporate income tax (cit) rate. Web corporate tax rates table. Web tax on corporate income is. Will Corporate Tax Rates Increase In 2021.

From www.coloradoan.com

Foolish Take How tax rates on rich have changed over time Will Corporate Tax Rates Increase In 2021 Web compare corporate tax rate by country. Web a basic guide to learn about corporate income tax in singapore e.g. Your company is taxed at a flat rate of 17% of its chargeable income. The corporate tax rate in singapore stands at 17 percent. Web companies with profits between £50,000 and £250,000 will pay tax at the main rate, reduced. Will Corporate Tax Rates Increase In 2021.

From taxfoundation.org

Corporate Tax Rates Around the World Tax Foundation Will Corporate Tax Rates Increase In 2021 Web companies with profits between £50,000 and £250,000 will pay tax at the main rate, reduced by a marginal relief. Web a basic guide to learn about corporate income tax in singapore e.g. •singapore may introduce a minimum effective tax rate. Tax rates, year of assessment, filing obligations, and tips for new companies. Web •no change to corporate income tax. Will Corporate Tax Rates Increase In 2021.

From www.zerohedge.com

'Fair Share' Around The World Where Corporate Taxes Are Set To Rise Will Corporate Tax Rates Increase In 2021 Web tax on corporate income is imposed at a flat rate of 17%. Web corporate tax rates table. Web in the financial year covering april 2020 to march 2021, when the pandemic was at its height, tax revenues fell to $49.6 billion from $53.5 billion. Web companies with profits between £50,000 and £250,000 will pay tax at the main rate,. Will Corporate Tax Rates Increase In 2021.

From www.chegg.com

Solved a. Sales for 2021 were 475,150,000, and EBITDA was Will Corporate Tax Rates Increase In 2021 Web corporate tax rates table. Web compare corporate tax rate by country. Web companies with profits between £50,000 and £250,000 will pay tax at the main rate, reduced by a marginal relief. Tax rates, year of assessment, filing obligations, and tips for new companies. Your company is taxed at a flat rate of 17% of its chargeable income. Web corporate. Will Corporate Tax Rates Increase In 2021.

From www.strashny.com

Raising the Corporate Rate to 28 Percent Reduces GDP by 720 Billion Will Corporate Tax Rates Increase In 2021 Web tax on corporate income is imposed at a flat rate of 17%. Tax rates, year of assessment, filing obligations, and tips for new companies. Web in the financial year covering april 2020 to march 2021, when the pandemic was at its height, tax revenues fell to $49.6 billion from $53.5 billion. Kpmg’s corporate tax table provides a view of. Will Corporate Tax Rates Increase In 2021.

From www.cbpp.org

Actual U.S. Corporate Tax Rates Are in Line with Comparable Countries Will Corporate Tax Rates Increase In 2021 Web corporate income tax (cit) rate. Web in the financial year covering april 2020 to march 2021, when the pandemic was at its height, tax revenues fell to $49.6 billion from $53.5 billion. Web companies with profits between £50,000 and £250,000 will pay tax at the main rate, reduced by a marginal relief. Web a basic guide to learn about. Will Corporate Tax Rates Increase In 2021.

From www.weforum.org

Corporate tax isn’t working how can we fix it, globally? World Will Corporate Tax Rates Increase In 2021 Kpmg’s corporate tax table provides a view of corporate tax rates around the world. Your company is taxed at a flat rate of 17% of its chargeable income. Web companies with profits between £50,000 and £250,000 will pay tax at the main rate, reduced by a marginal relief. Web in the financial year covering april 2020 to march 2021, when. Will Corporate Tax Rates Increase In 2021.

From efiletaxonline.com

2024 State Corporate Tax Rates & Brackets Will Corporate Tax Rates Increase In 2021 Kpmg’s corporate tax table provides a view of corporate tax rates around the world. Web compare corporate tax rate by country. Your company is taxed at a flat rate of 17% of its chargeable income. Web corporate income tax (cit) rate. Tax rates, year of assessment, filing obligations, and tips for new companies. •singapore may introduce a minimum effective tax. Will Corporate Tax Rates Increase In 2021.

From www.arkansasonline.com

Top corporate tax rate declines Will Corporate Tax Rates Increase In 2021 The corporate tax rate in singapore stands at 17 percent. Web corporate tax rates table. Tax rates, year of assessment, filing obligations, and tips for new companies. •singapore may introduce a minimum effective tax rate. Web a basic guide to learn about corporate income tax in singapore e.g. Web in the financial year covering april 2020 to march 2021, when. Will Corporate Tax Rates Increase In 2021.

From taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation Will Corporate Tax Rates Increase In 2021 Tax rates, year of assessment, filing obligations, and tips for new companies. Web corporate tax rates table. Web corporate income tax (cit) rate. •singapore may introduce a minimum effective tax rate. Web in the financial year covering april 2020 to march 2021, when the pandemic was at its height, tax revenues fell to $49.6 billion from $53.5 billion. Web •no. Will Corporate Tax Rates Increase In 2021.

From taxfoundation.org

State Corporate Taxes Increase Tax Burden on Corporate Profits Will Corporate Tax Rates Increase In 2021 Your company is taxed at a flat rate of 17% of its chargeable income. Web companies with profits between £50,000 and £250,000 will pay tax at the main rate, reduced by a marginal relief. Tax rates, year of assessment, filing obligations, and tips for new companies. Web in the financial year covering april 2020 to march 2021, when the pandemic. Will Corporate Tax Rates Increase In 2021.

From taxfoundation.org

Combined State and Federal Corporate Tax Rates in 2022 Will Corporate Tax Rates Increase In 2021 Tax rates, year of assessment, filing obligations, and tips for new companies. Kpmg’s corporate tax table provides a view of corporate tax rates around the world. •singapore may introduce a minimum effective tax rate. Web corporate income tax (cit) rate. The corporate tax rate in singapore stands at 17 percent. Web a basic guide to learn about corporate income tax. Will Corporate Tax Rates Increase In 2021.